Page 29 - RFCUNY Annual Report 2016

P. 29

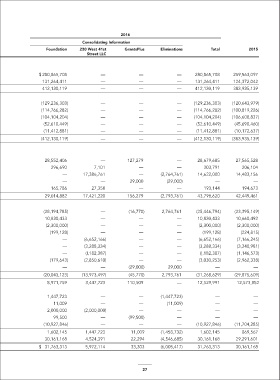

2016

Consolidating Information

Foundation 230 West 41st GrantsPlus Eliminations Total 2015

Street LLC

Grants and contracts administered for others:

Revenue:

Governmental $ 280,865,708 — — — 280,865,708 259,563,097

Private 131,264,411 — — — 131,264,411 124,372,042

Total grants and contracts revenue 412,130,119 — — — 412,130,119 383,935,139

Expenses:

Research (129,236,303) — — — (129,236,303) (120,643,979)

Training (114,766,282) — — — (114,766,282) (100,819,226)

Academic development (104,104,204) — — — (104,104,204) (106,608,837)

Student services (52,610,449) — — — (52,610,449) (45,690,460)

Other (11,412,881) — — — (11,412,881) (10,172,637)

Total grants and contracts expenses (412,130,119) — — — (412,130,119) (383,935,139)

Administrative services:

Revenue:

Administrative fees 28,552,406 — 127,279 — 28,679,685 27,565,528

Investment return (note 3) 296,690 7,101 — — 303,791 206,104

Rental income (notes 6 and 9) — 17,386,761 — (2,764,761) 14,622,000 14,483,156

Donated services — — 29,000 (29,000) — —

Other 165,786 27,358 — — 193,144 194,673

Total administrative revenue 29,014,882 17,421,220 156,279 (2,793,761) 43,798,620 42,449,461

Expenses:

Management and general (28,194,785) — (16,770) 2,764,761 (25,446,794) (23,395,149)

Postretirement credit (note 4) 10,830,433 — — — 10,830,433 10,660,492

Grants to CUNY for central research initiatives (note 9) (2,300,000) — — — (2,300,000) (2,300,000)

Investment return allocated to individual colleges (199,128) — — — (199,128) (224,815)

Operating expenses of 230 West 41st Street LLC (note 10) — (6,652,166) — — (6,652,166) (7,166,245)

Interest expense — (3,288,334) — — (3,288,334) (3,340,981)

Real estate taxes (note 11) — (I,182,387) — — (I,182,387) (1,146,573)

Depreciation and amortization (179,643) (2,850,610) — — (3,030,253) (2,962,338)

Donated expenses (note 9) — — (29,000) 29,000 — —

Total administrative expenses (20,043,123) (13,973,497) (45,770) 2,793,761 (31,268,629) (29,875,609)

Excess of revenue over expenses before other changes 8,971,759 3,447,723 110,509 — 12,529,991 12,573,852

Other changes:

Change in Foundation investment in 230 West 41st Street LLC 1,447,723 — — (1,447,723) — —

Change in Foundation investment in GrantsPlus 11,009 — — (11,009) — —

230 West 41st Street LLC distribution to Foundation 2,000,000 (2,000,000) — — — —

GrantsPlus distribution to Foundation (note 9) 99,500 — (99,500) — — —

Postretirement benefits changes other than net periodic benefit cost (note 4) (10,927,846) — — — (10,927,846) (11,704,285)

Increase in net assets 1,602,145 1,447,723 11,009 (1,458,732) 1,602,145 869,567

Net assets at beginning of year 30,161,168 4,524,391 22,294 (4,546,685) 30,161,168 29,291,601

Net assets at end of year $ 31,763,313 5,972,114 33,303 (6,005,417) 31,763,313 30,161,168

See accompanying notes to consolidated financial statements.

27