Page 34 - RFCUNY Annual Report 2016

P. 34

Research Foundation of The City University of New York and Related Entities

Notes to Consolidated Financial Statements

June 30, 2016 and 2015

(n) Income Taxes

The effects of uncertain tax positions are recognized only if those positions are more likely than not of

being sustained. No such positions have been recorded in the consolidated financial statements as of

June 30, 2016 or 2015.

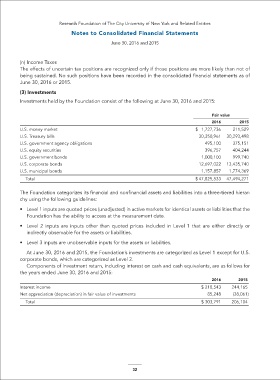

(3) Investments

Investments held by the Foundation consist of the following at June 30, 2016 and 2015:

Fair value

2016 2015

U.S. money market $ 1,727,736 211,529

U.S. Treasury bills 30,350,961 30,293,498

U.S. government agency obligations 495,100 375,151

U.S. equity securities 396,757 404,244

U.S. government bonds 1,000,100 999,740

U.S. corporate bonds 12,697,022 13,435,740

U.S. municipal bonds 1,157,857 1,774,369

Total $ 47,825,533 47,494,271

The Foundation categorizes its financial and nonfinancial assets and liabilities into a three-tiered hierar-

chy using the following guidelines:

• Level 1 inputs are quoted prices (unadjusted) in active markets for identical assets or liabilities that the

Foundation has the ability to access at the measurement date.

• Level 2 inputs are inputs other than quoted prices included in Level 1 that are either directly or

indirectly observable for the assets or liabilities.

• Level 3 inputs are unobservable inputs for the assets or liabilities.

At June 30, 2016 and 2015, the Foundation’s investments are categorized as Level 1 except for U.S.

corporate bonds, which are categorized as Level 2.

Components of investment return, including interest on cash and cash equivalents, are as follows for

the years ended June 30, 2016 and 2015:

2016 2015

Interest income $ 218,543 244,165

Net appreciation (depreciation) in fair value of investments 85,248 (38,061)

Total $ 303,791 206,104

32