Page 37 - RFCUNY Annual Report 2016

P. 37

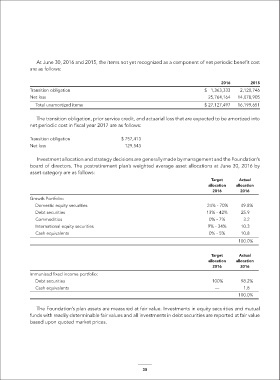

At June 30, 2016 and 2015, the items not yet recognized as a component of net periodic benefit cost

are as follows:

2016 2015

Transition obligation $ 1,363,333 2,120,746

Net loss 25,764,164 14,078,905

Total unamortized items $ 27,127,497 16,199,651

The transition obligation, prior service credit, and actuarial loss that are expected to be amortized into

net periodic cost in fiscal year 2017 are as follows:

Transition obligation $ 757,413

Net loss 129,543

Investment allocation and strategy decisions are generally made by management and the Foundation’s

board of directors. The postretirement plan’s weighted average asset allocations at June 30, 2016 by

asset category are as follows:

Target Actual

allocation allocation

2016 2016

Growth Portfolio:

Domestic equity securities 24% - 70% 49.8%

Debt securities 13% - 42% 25.9

Commodities 0% - 7% 3.2

International equity securities 9% - 34% 10.3

Cash equivalents 0% - 5% 10.8

100.0%

Target Actual

allocation allocation

2016 2016

Immunized fixed income portfolio:

Debt securities 100% 98.2%

Cash equivalents — 1.8

100.0%

The Foundation’s plan assets are measured at fair value. Investments in equity securities and mutual

funds with readily determinable fair values and all investments in debt securities are reported at fair value

based upon quoted market prices.

35