Page 40 - RFCUNY Annual Report 2016

P. 40

Research Foundation of The City University of New York and Related Entities

Notes to Consolidated Financial Statements

Years ended June 30, 2016 and 2015

(b) Letter of Credit

In fiscal year 2008, the Foundation entered into an agreement with one of its health insurance carriers

whereby the Foundation is required to pay the carrier, in advance, for claims incurred but not reported in

the event of plan termination. The carrier has allowed the Foundation to retain this payment, which totals

$3,254,491 and is included as a component of accounts payable and accrued expenses on the accompa-

nying consolidated balance sheets as of June 30, 2016 and 2015, and is secured by an irrevocable letter

of credit to the carrier for the same amount, which expires on December 31, 2016.

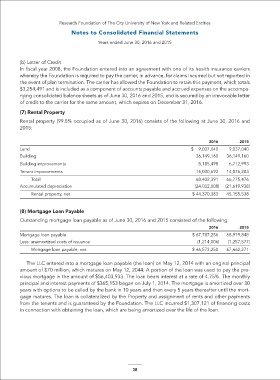

(7) Rental Property

Rental property (99.8% occupied as of June 30, 2016) consists of the following at June 30, 2016 and

2015:

2016 2015

Land $ 9,037,040 9,037,040

Building 36,149,160 36,149,160

Building improvements 8,185,498 6,712,993

Tenant improvements 15,030,693 14,876,283

Total 68,402,391 66,775,476

Accumulated depreciation (24,032,008) (21,619,938)

Rental property, net $ 44,370,383 45,155,538

(8) Mortgage Loan Payable

Outstanding mortgage loan payable as of June 30, 2016 and 2015 consisted of the following:

2016 2015

Mortgage loan payable $ 67,787,256 68,919,848

Less: unamortized costs of issuance (1,214,006) (1,257,577)

Mortgage loan payable, net $ 66,573,250 67,662,271

The LLC entered into a mortgage loan payable (the loan) on May 12, 2014 with an original principal

amount of $70 million, which matures on May 12, 2044. A portion of the loan was used to pay the pre-

vious mortgage in the amount of $56,403,933. The loan bears interest at a rate of 4.75%. The monthly

principal and interest payments of $365,153 began on July 1, 2014. The mortgage is amortized over 30

years with options to be called by the bank in 10 years and then every 5 years thereafter until the mort-

gage matures. The loan is collateralized by the Property and assignment of rents and other payments

from the tenants and is guaranteed by the Foundation. The LLC incurred $1,307,121 of financing costs

in connection with obtaining the loan, which are being amortized over the life of the loan.

38