Page 36 - RFCUNY Annual Report 2016

P. 36

Research Foundation of The City University of New York and Related Entities

Notes to Consolidated Financial Statements

Years ended June 30, 2016 and 2015

2016 2015

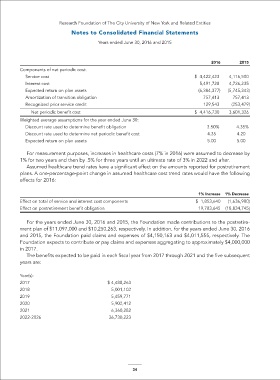

Components of net periodic cost:

Service cost $ 4,422,423 4,116,500

Interest cost 5,491,728 4,726,235

Expected return on plan assets (6,384,377) (5,745,343)

Amortization of transition obligation 757,413 757,413

Recognized prior service credit 129,543 (253,479)

Net periodic benefit cost $ 4,416,730 3,601,326

Weighted average assumptions for the year ended June 30:

Discount rate used to determine benefit obligation 3.50% 4.35%

Discount rate used to determine net periodic benefit cost 4.35 4.20

Expected return on plan assets 5.00 5.00

For measurement purposes, increases in healthcare costs (7% in 2016) were assumed to decrease by

1% for two years and then by .5% for three years until an ultimate rate of 3% in 2022 and after.

Assumed healthcare trend rates have a significant effect on the amounts reported for postretirement

plans. A one-percentage-point change in assumed healthcare cost trend rates would have the following

effects for 2016:

1% Increase 1% Decrease

Effect on total of service and interest cost components $ 1,853,640 (1,636,980)

Effect on postretirement benefit obligation 19,783,645 (18,834,745)

For the years ended June 30, 2016 and 2015, the Foundation made contributions to the postretire-

ment plan of $11,097,000 and $10,250,263, respectively. In addition, for the years ended June 30, 2016

and 2015, the Foundation paid claims and expenses of $4,150,163 and $4,011,555, respectively. The

Foundation expects to contribute or pay claims and expenses aggregating to approximately $4,000,000

in 2017.

The benefits expected to be paid in each fiscal year from 2017 through 2021 and the five subsequent

years are:

Year(s):

2017 $ 4,488,263

2018 5,001,102

2019 5,459,771

2020 5,902,412

2021 6,360,282

2022-2026 36,730,223

34